Renters Insurance in and around Webster

Webster renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Calling All Webster Renters!

It may feel like a lot to think through your busy schedule, work, your sand volleyball league, as well as providers and coverage options for renters insurance. State Farm offers no-nonsense assistance and impressive coverage for your tools, home gadgets and musical instruments in your rented property. When the unexpected happens, State Farm can help.

Webster renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Why Renters In Webster Choose State Farm

You may be wondering: Is renters insurance really necessary? Think for a moment about how much it would cost to replace your belongings, or even just a few high-cost things. With a State Farm renters policy behind you, you won't be slowed down by windstorms or tornadoes. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've secured in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. With so much of your life accessible online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent Frank C Argento Jr can help you add identity theft coverage with monitoring alerts and providing support.

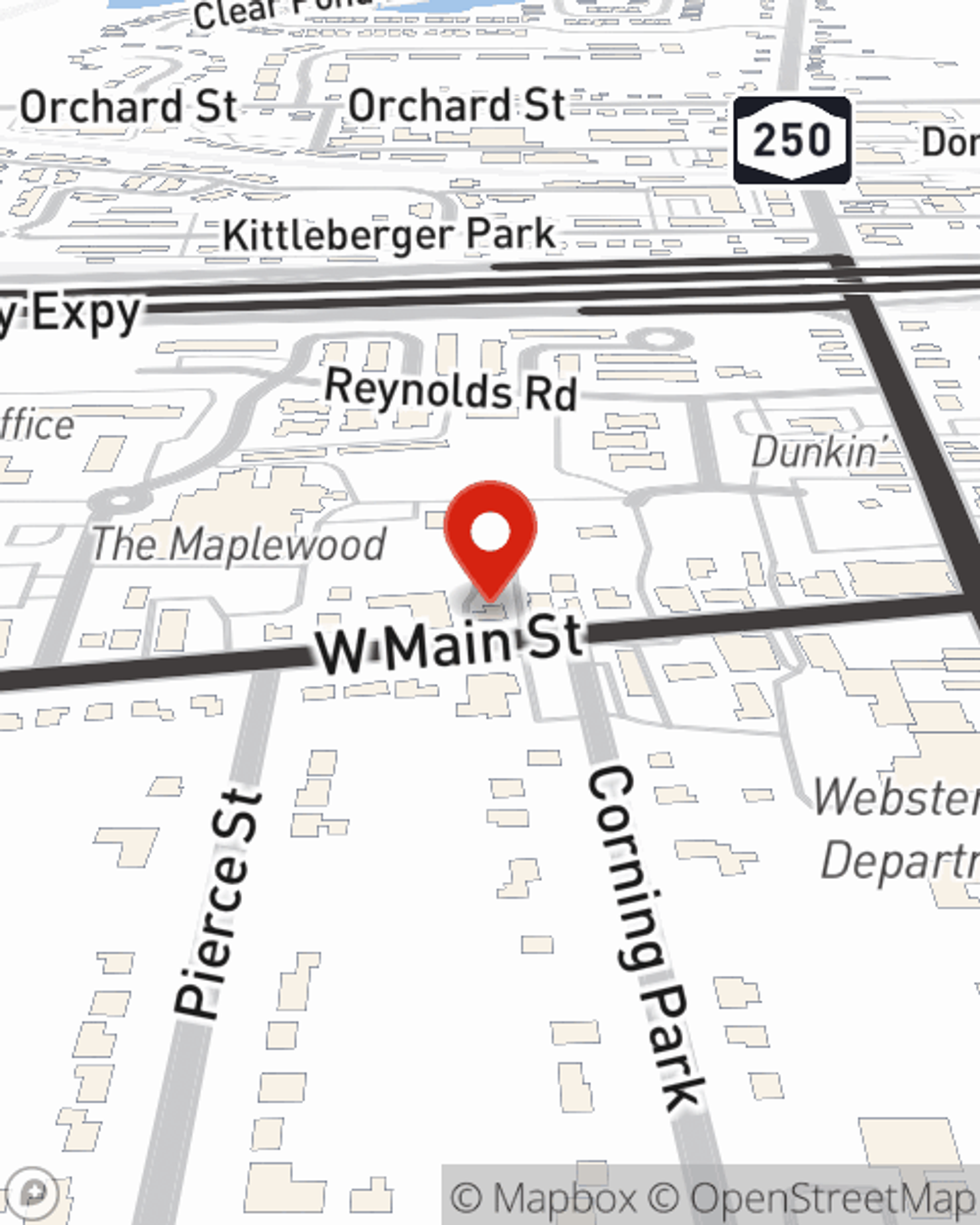

If you're looking for a value-driven provider that can help with all your renters insurance needs, get in touch with State Farm agent Frank C Argento Jr today.

Have More Questions About Renters Insurance?

Call Frank C at (585) 265-3930 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.

Frank C Argento Jr

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

What is an e-bike?

What is an e-bike?

If you’re wondering what sets an e-bike apart from a regular bike or want details on e-bike insurance, read on for the answers to these questions and more.